Frugal Living Tips

When my husband and I got serious about starting our online business we decided to focus on where our money was going every month. After we had a budget meeting we learned that we would spend a lot of money every single month on fast food. After that, we decided to create a FUN budget and stick to it. One of the ways that helped us stick to our budget was finding frugal ways we could save money but also still enjoy life. This post will share 12 frugal living tips that will help save you thousands each year.

Related Posts

- 15 Frugal DIY Home Decor and Project Ideas

- 70 Frugal Meal Ideas For A Tight Budget

- 11 Budget-Friendly DIY Decorations for Any Season

Table of Contents

12 Genius Frugal Living Tips That Will Save You Thousands Every Year

1. Use The Ibotta App

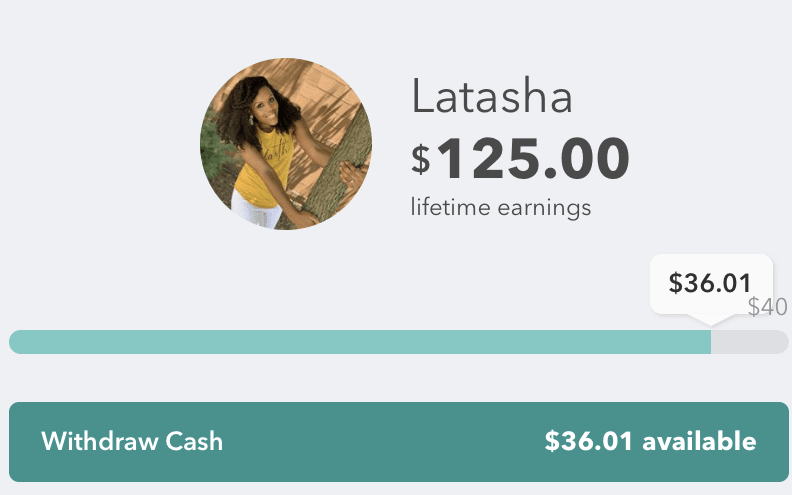

One of the best ways to save money every single day is by using a cash-back app. Currently, one of my favorite cash-back apps is Ibotta. Ibotta is an app where you can upload your receipts and earn cash-back on a daily basis. This app has a list of items that you can put on your personal Ibotta list and if you purchase those items while at the store you will earn money. It’s that simple.

Within’ the last few months, I have earned money from uploading receipts onto the Ibotta app and all the money I earned went into my Christmas fund for this year.

So, if you are looking to save money and also make extra money, totally check out Ibotta by clicking here!

2. Save Money While Shopping Online

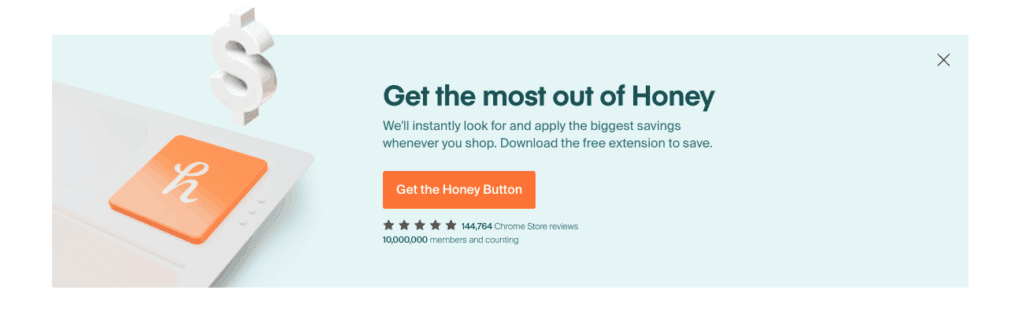

Another frugal living tip is to use an online website that offers automatic coupons and promo codes such as Honey. Honey is a browser extension that finds the best deals for you instantly when you get to the checkout during online shopping. This browser extension finds the best deals within’ seconds. It’s one of my favorite extensions, and it always helps me save money on my online purchases. Check out Honey by clicking here. Also, if you refer two friends to the Honey, they will send you a $10 gift card to your favorite store. It sounds like a win to me!

[optin-monster-shortcode id=”bgefu8acu4oyuyiznhia”]

3. Save and Earn Money With Fetch Rewards

Fetch Rewards is probably my favorite cashback site right now. If you are looking to save money, totally check out the Fetch Rewards app! With this free app, you can turn any grocery receipt into rewards and earn cashback.

Every time you go to the store, you can save on hundreds of products just by uploading your receipts on this app.

So far, I have gained over 70,000 + points just by adding my receipts and referring my friends to the app. This means I was able to get $70 worth of gift-cards of my choice! I picked the Amazon gift-card, which went to my Christmas shopping fund. Right now if you sign up and use my referral code UTA17 when you sign up, you will gain 2000 points instantly!

Check out Fetch Rewards by clicking here. What are your favorite apps to use to make and save money?

3. Join Swagbucks and earn $10

Swagbucks is one of my favorite websites to earn gift cards from. With Swagbucks, you can earn points that are called “swag bucks” and redeem them for gift cards to places such as Macy’s, Target, Walmart, Amazon, and much more.

They even have an option where you can get a PayPal gift card, which is cash being directed into your PayPal account.

On Swagbucks, you can earn the most points by referring others to the website, using the site as a search engine and by taking surveys on the site. Right now when you sign up you will earn $10 towards a gift card of your choice. Check out Swagbucks by clicking here.

4. Set Up A Fun Budget

Throughout my debt-free journey, I like to make the budgeting process fun! Below are some ways how I make budgeting each month fun.

- Use A Budget Planner: Getting a budget planner can make the budgeting process fun! If you are looking for budgeting templates, I have a set called the Money Boost Bundle, which is a set of budgeting printables to help make budgeting fun and easy. Check out the Money Boost Bundle by clicking here.

- Reward Yourself: Celebrate your wins and reward yourself throughout the process! Rewarding yourself will give you something to look forward to. Woo hoo!

- Use Colorful Supplies: I love using colorful markers, highlighters, post-it notes, and other colorful supplies while creating my monthly budget. Who else?

- Join A Positive Community: Let me say joining the DEBT FREE COMMUNITY on Instagram has been a game-changer for me! That community has inspired me to pay off all my debt ultimately. If you are looking for support on your budgeting journey, totally join a community like the DEBT FREE Community on Instagram!

- Find Your Why: So, what’s the main reason you want to set up a budget each month? Is it because you want to be debt-free? Is it because you want to get your finances in order? For me, my why is my family… My husband and our two sons! We desire to give our sons a backyard one day in a house that is completely paid off. So really think about why you want to set up a budget because that will drive on days where you don’t feel like setting up one.

5. Use Colorful Cash Envelopes

The cash envelope system helps individuals stick to a weekly and monthly budget. With this system, you will put your expenses into envelope categories such as gas, food, entertainment/fun, groceries, and more!

After each paycheck, you put a certain amount of money in each envelope category and only spend the amount you put in the envelope until your next payday. This system has helped me live a frugal life but also makes it super fun.

6. Free Entertainment In Your Town

Another frugal living option is to check out free entertainment in your town. In my town, there is always a free concert or event that happens each week. So check out your town’s website and see what’s happening.

There might be some events that spark your interest. If some of the functions do grab your attention get some friends and make it a night on the town. Checking out free entertainment is a great way to save money and also have a ton of fun.

7. Take A Shopping list To The Store

If I don’t create a shopping list before I go shopping for food, my whole budget is usually thrown out. To help with frugal living, take a shopping list when you go shopping and try not to shop hungry. I recently read a study that said if you go into a store hungry, you will buy more food, no matter the cost. I am not sure how true that is, but in my case, it’s very accurate. =)

8. Set Up A Weekly Meal Plan

Let me be the first to say if I don’t set up a weekly meal plan my whole week of cooking is off.

Yup, totally thrown off!

So, to help me plan out my week, I set up a weekly meal plan. This not only helps me save money, but it helps me stay organized throughout the week.

To find meal ideas, go on Pinterest and type in the keywords “Lunch and Dinner Recipes.” After you type in those keywords, a ton of recipes ideas will pop up in your feed.

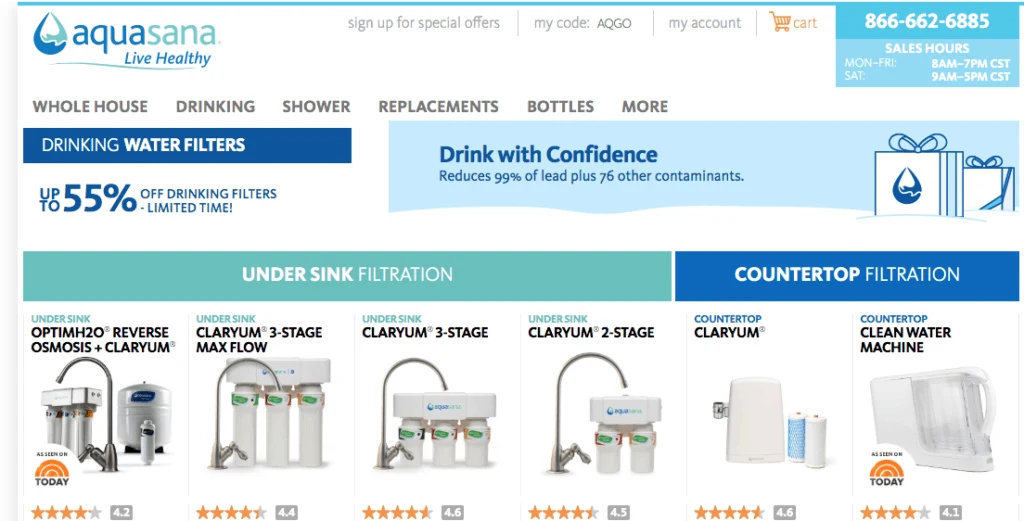

9. Save Money On Water

My husband and I decided to stop buying bottled water for a whole three months, and we saved so much money. I am all for clean water, so we currently use a water filter in our house. This helps us save money, and also have clean water.

Now not all water filters are created equal! My favorite water filters are by Aquasana. They have a large selection, and they are very affordable. I think it’s worth it if you drink a ton of water like me. Check out Aquasana by clicking here.

10. Use Airbnb + $20 Credit

If you are going out of town and need a place to stay, I highly recommend getting an Airbnb house. Airbnb is a marketplace that connects people who want to rent out their apartments, houses, or rooms to people who are looking for places to stay for a short period of time. For an Airbnb host, this is a way to increase income, and for people looking for a place to stay while on vacation, this will help them save a ton of money.

When my husband and I went to California, we saved a ton of money on our stay by booking an Airbnb house. When you book an Airbnb place not only can you get a whole house but you can travel frugally and not spend a ton of money on your stay. So, I highly recommend Airbnb, and right now you can get a $20 credit towards your next booking by clicking here.

11. Create DIY Projects

I love a good DIY project, so I wanted to include this idea in my top frugal living tips. If you love creating DIY projects for your home and for the holidays jumping on Pinterest will help give you a ton of ideas to get started.

To find inspiration on Pinterest go to the search box and type in the keywords “DIY Projects“. After you type in that keyword phrase a ton to see a ton of different DIY projects ideas will pop up. Also, I have a post on my site that shares 11 Budget-Friendly DIY Decorations for Any Season. Check it out by clicking here.

12. Find Savings on Everyday Household Expenses

Another great frugal living tip is to see which costs you can cut back on to save money. Below I created an infographic to give you a better idea of some of the expenses a person can cut back on to save money.

- Buying name brand items

- Cable Bill

- Subscription Services (Hulu, Disney Plus, Netflix)

- Fast food

- Groceries Expenses

- Utility Bills

- Cell Phone bill

Those are some of the areas my husband and I were able to cut back on to save money.

Final Thoughts

If you are looking to live frugally and have fun, you totally can achieve that. This post shared some of the best frugal living tips to help you save thousands per year and also still have fun.

Frugal living tips